Introduction

As anyone who has dipped a toe into the vast ocean of insurance marketing knows, it’s an intricate ecosystem teeming with diverse lead sources, varying acquisition costs, distinct territories, and a myriad of other variables that can make or break a successful marketing strategy.

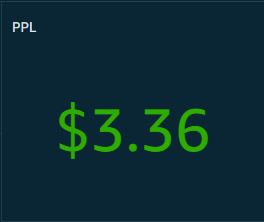

As the saying goes, “what gets measured gets managed.” But what should we be measuring, and how? This is where the Profit per Lead (PPL) metric steps onto the stage, twirls a baton, and says, “Watch this!”

Understanding Profit per Lead (PPL)

Let’s not just dip our toes; let’s dive into what PPL is. PPL is a key performance indicator (KPI) that measures the return on investment (ROI) of an insurance client’s marketing resources and sales staff.

In its simplest form, the PPL equation is:

Profit per Lead (PPL) = (New Customer Commission – Total Lead Cost) / Lead Count

This equation essentially measures the average profit generated from each lead. The aim is to maximize this value, hence driving overall profitability.

The Art of Tracking PPL

Now that we’ve established what PPL is, let’s address the elephant in the room – why should we care? The truth is, tracking PPL across various parameters like lead source, producer, zip code, sub source, and much more can be your secret weapon.

- Lead Source: By comparing PPL from different lead sources, you can understand where your most profitable leads are coming from. This insight allows you to reallocate your marketing budget to more lucrative sources.

- Producer: Not all producers are created equal, and PPL can help identify your allstars. By funneling more leads to producers with higher PPLs, you increase your overall profitability.

- Geography: Tracking PPL by zip code can reveal lucrative and under-performing territories. By leveraging this data, you can fine-tune your marketing strategy to target areas with higher PPL.

- Sub-source: By digging into the nitty-gritty of lead sources, PPL can expose which specific channels are performing the best.

Imagine you are a captain, and PPL is your trusty compass. It’s directing you where to steer your ship – toward the tranquil waters of high profitability and away from the stormy seas of waste.

In the game of insurance marketing, where every cent counts, knowing where to stop buying leads and where to increase spend based on ROI is a superpower. It can help you shift your marketing budget from an expense to an investment.

Similarly, PPL gives you the power to see who among your producers are the “superheroes,” the ones who can take a lead and turn it into a profitable policyholder. They may wear suits instead of capes, but they can be a driving force behind your success.

Conclusion

Just as a jigsaw puzzle comes together to reveal a complete picture, PPL brings together different parts of your marketing efforts to present a clear view of your profitability landscape.

When used effectively, PPL is a dynamic KPI that can inform data-driven decisions, thereby reducing guesswork and enhancing profitability.

So, put on your thinking cap, grab your PPL compass, and chart your course through the challenging yet rewarding world of insurance marketing. Here’s to higher profitability and smoother sailing ahead!

This white paper was brought to you by insurance marketers who are just as passionate about maximizing profits as they are about inserting personality into analytical topics. We hope you found it informative and engaging. Stay tuned for our next edition where we’ll explore more exciting insights and trends in insurance marketing!

April 22, 2024

Engaging with a Twist: How Insurance Agents Can Amp Up SMS Follow-Ups with Prospects

Ditch the mundane follow-up texts and inject some humor…

January 12, 2024

Custom Dashboards: Transforming Data into Actionable Insights for Insurance Agents

Custom dashboards in insurance are not just data…

January 10, 2024

The Role of a CRM in Boosting Insurance Agents’ Productivity and Customer Satisfaction

Explore the impactful role of CRM tools in enhancing the…

January 9, 2024

Building a Robust Prospect Database: Key to Insurance Agents’ Success

Discover how a robust prospect database, far beyond a mere…

January 5, 2024

Mastering Time Management: The Pomodoro Technique for Insurance Agents

Learn key strategies for effective time management tailored…

June 26, 2023

Unlocking the ROI Puzzle: How Attribution Modeling Empowers Insurance Agents

In the end, it's all about the Benjamins. By using…